The Future of Work – A New Report into Evolving Trends

At NatWest Rapid Cash, we often work with recruitment agencies, we’ve lent over £19 million to SMEs in this sector. Our experience has given us an insight into the challenges recruiters face, as they look to grow in the current climate and seize all opportunities available to them.

At NatWest Rapid Cash, we often work with recruitment agencies, we’ve lent over £19 million to SMEs in this sector. Our experience has given us an insight into the challenges recruiters face, as they look to grow in the current climate and seize all opportunities available to them.

But the landscape is fast-moving and has changed rapidly in recent years. Today, employees expect flexible working options, and a four-day work week* “100% of pay for 80% of the time, in exchange for a commitment to maintain 100% productivity”, could be on the horizon for the UK. SME businesses may need to adapt their business models to match employee expectations and remain competitive.

We’ve commissioned an independent survey to better understand:

- How the attitudes of employees towards ways of working trends compare to employers and recruiters.

- How evolving ways of working trends impact recruiters - and the operational and financial challenges they face in the current landscape.

- How SMEs can pivot and adapt to facilitate new ways of working trends.

We hope this research will help to inform both SMEs and recruitment agencies about the evolving landscape of work, while also anticipating when changes could occur based on the attitudes of office workers. Here’s what we found.

Our survey results: Key findings

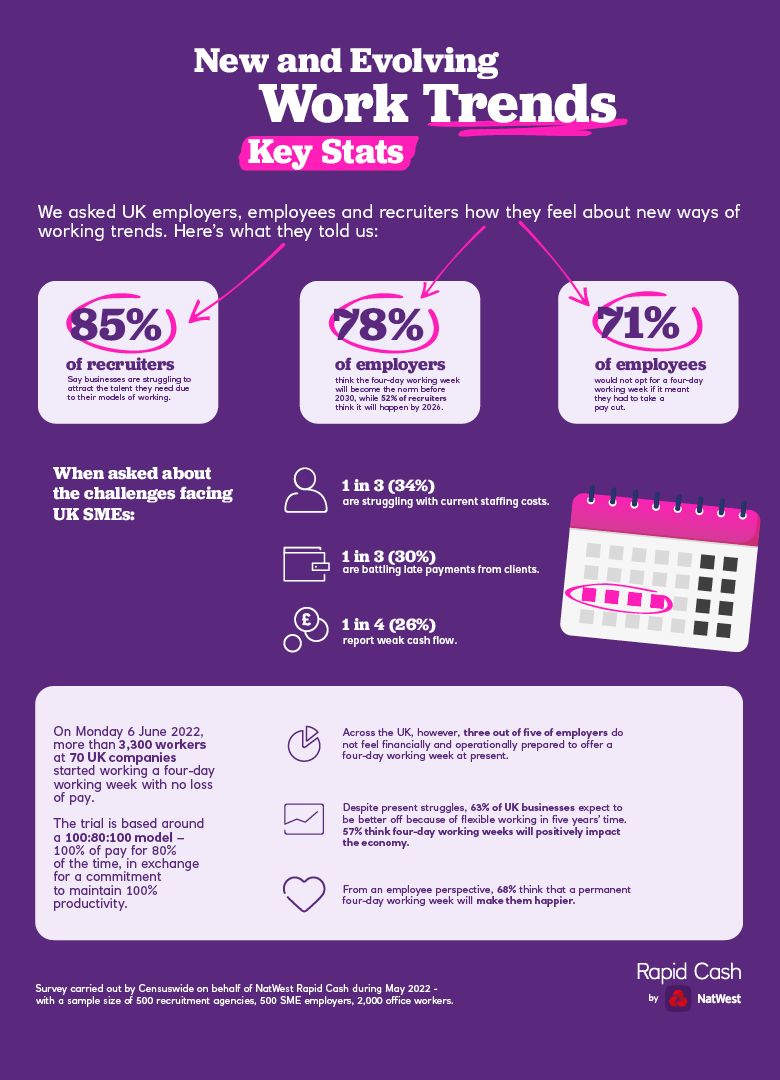

Survey carried out by Censuswide on behalf of NatWest Rapid Cash during May 2022 - with a sample size of 500 recruitment agencies, 500 SME employers, 2,000 office workers.

Flexible working has already changed our economy and the trend looks set to continue throughout the 2020s. Recruiters and employers across the country must overcome current financial and operational challenges if they are to realise its potential to improve both the economy and the mental health and wellbeing of their employees.

How do attitudes toward working trends differ between Employers, Employees and Recruiters?

We asked our three sample groups how they feel about the following statement: “I believe the four-day work week is a good idea”. Interestingly;

- 88% of employees agreed or strongly agreed.

- 76% of SME employers agreed or strongly agreed.

- 86% of recruiters agreed or strongly agreed.

Clearly, there is resounding support from all respondents for the notion of a four-day working week, despite employers seeming slightly less optimistic about the concept than employees. When asked whether offering a four-day working week automatically makes an employer more appealing:

- 88% of employees agreed or strongly agreed.

- 79% of SME employers agreed or strongly agreed.

- 88% of recruiters agreed or strongly agreed.

SMEs that capitalise on this trend and offer flexible working options to their employees could potentially edge out over their competition when it comes to attracting new candidates – and recruiters predict that this is how the market is moving.

In fact, 78% of recruiters believe that the four-day work week will be a reality in the UK by the end of the decade.

What does this data mean for SMEs?

So, it could be useful for SME owners to consider the real-world impact of four-day workweeks on their operations. But how do employers currently feel about this prospect? When listing the potential impacts, they told us that:

The pros could be:

- Happier employees (60%).

- More flexibility for staff (60%).

- Increased employee retention (47%).

- Increased productivity (48%).

The cons could be:

- Having to find cover for a workload (46%).

- Reduced hours might reduce work output (45%).

Interestingly, when asked specifically about productivity, 78% of office workers think the four-day workweek could bring about a somewhat positive or very positive impact – a sentiment 68% of SME employers seem to share.

What insights do recruiters have on the evolving world of work?

Recruiters play a vital role in the jobs market. They help bridge the gap between employee and employer, and are in touch with real-world attitudes on key issues and trends.

Some key insights from recruitment agencies include:

- Recruiters agree that total flexible working is more popular among candidates (31%) than the four-day working week (26%).

- They believe that the UK sectors which hold the most job role opportunities include healthcare (44%), IT (37%), and technology (36%).

In terms of opinions towards the four-day week, recruiters think a shorter workweek would have a positive impact on:

- Mental health and wellbeing (87%).

- Productivity (77%).

- Standards of living (76%).

- The UK economy (70%).

Recruiters are looking to stay ahead of working trends and strive to connect employees with employers quickly and effectively. However, with the number of job vacancies from January - March 2022 rising to a new record in the UK of 1,288,000, recruiters themselves must fend off pressures associated with growth.

When asked what the core challenges facing recruiters are, they told us:

- Rising costs (44%).

- Candidates are looking for more than employers are offering (40%).

- Lack of flexibility from employers on remote working (39%).

- Lack of available candidates (37%) and lack of roles (18%).

When looking at how these rising costs break down, staffing costs and late payments were reported as the most significant challenges. It could, therefore, be crucial that recruiters take full control over their cash flow and take steps to ensure they’re properly equipped to manage rising costs.

At NatWest Rapid Cash, we have years of expertise in supporting the recruitment industry and understand the pressures recruiters face. Our invoice financing solution is specialised in helping SMEs overcome the exact cost-based issues businesses are struggling with according to our survey findings. NatWest Rapid Cash could enable businesses to strengthen their cash flow and invest at critical moments to drive growth.

Ultimately, there’s more SMEs can do to account for the evolving ways of work from a financial perspective. But recruiters also report that remote working and the needs of candidates are the other core challenges to focus on, and adapt to, in the current climate.

How could business leaders adapt to the UK’s evolving ways of working?

As well as comparing attitudes on key trends, our survey also sought to gauge what the real-world impact of these trends could be on businesses and recruitment agencies in the short to mid-term.

Over a third of UK SMEs in our survey identified staffing costs as a pressure point that’s impacting their cash flow. That’s a significant number, and candidates may demand more from employers both on the wage front to contend with the cost of living, and around ways of working - as our research suggests.

But businesses may not be in the best shape to tackle challenging staffing costs, with 30% currently battling late payments from their own clients, and a quarter of SMEs suffering from weak cash flow. Innovative financing solutions and a revised offering to employees may, therefore, help businesses remain competitive and attract quality candidates in the current climate.

Looking forward

Beyond the present, we looked to understand the impact ways of working trends could have on SME bottom lines. The data indicates that the impact could, in fact, be positive on the whole. We asked employers what the exact financial and operational impact of a four-day workweek could be, and they told us that they would expect:

- Reduced employee burnout (27%).

- 35% of SME Directors expect less overall business expenditure.

- 30% of Managers expect an increase in business productivity.

Consequently, the implementation of new ways-of-working trends could see SMEs paying less money for office rental costs, which are often one of the most expensive overheads businesses face - while simultaneously benefitting from an increase in employee productivity.

It’s important to note, however, that the four-day week isn’t likely to be implemented today, or even this year. We found that only 25% of respondents currently offer a four-day week, and 60% of all employers do not feel financially and operationally prepared to offer a four-day work week at present.

That said, a third of employers say they will implement a four-day week if they must, while 43% intend to implement one but haven’t gotten around to it yet. Ultimately, 79% of employers expect the four-day week to be implemented in the UK by 2030.

What actions can SMEs take based on this research?

The data that has emerged from this research piece tells a clear story of how views toward emerging ways of working trends, such as flexible working and the four-day week, are positive on the whole. It also indicates that businesses don’t yet feel financially equipped to properly implement four-day working weeks, with over a quarter of SMEs suffering from weak cash flow.

As recruiters and SMEs look to manage their costs while adapting and reacting to the evolving jobs market, it’s crucial that they’re able to connect with employees to gauge expectations, benchmark against their competition, and finance their operations. In this way they can ensure they’re well-positioned to grow and thrive as the jobs landscape continues to evolve.

Natalie Kerr, Chief Commercial Director at NatWest Rapid Cash says:

“Recruiters clearly see the four-day working week and personal wellbeing gaining popularity among employees. But many businesses are reluctant to provide a better work/life balance due to increased operational costs.

“At NatWest Rapid Cash, we believe the most effective way for SME employers, and recruiters, to meet staffing challenges is to strengthen their working capital. Cashflow is key when it comes not only to staffing but also to having the flexibility to adopt new models of working, and to make the most of growth opportunities.

“NatWest Rapid Cash has been designed for just this, helping businesses improve their cashflow by unlocking capital in unpaid invoices.”

Rapid Cash-eligibility criteria apply. Security and guarantee required. Fees may apply.